– Churn and Burn – RAMP UP – Rotation (Renting Space)

– Long Stretch with limited volatility

– Short Interest at MULTI year lows

– NVDA becomes worlds MVC for a minute

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Summer Spin Cycle

- New flow shifting to election

- Banks - Fed's Stress Test Results (Wednesday)

- Last week of month and quarter!

Market Update

- Churn and Burn - RAMP UP - Rotation (Renting Space)

- Long Stretch with limited volatility

- Short Interest at MULTI year lows

- NVDA becomes worlds MVC for a minute

Next week is JULY 4th

- Markets closing early (1PM) on Wednesday

- Markets Closed on Thursday

- Most people will take Friday off!

Short Interest

- Multi-Year low on S&P 500 and stocks

- Hedge fund disclosures stopping some from shorting (after Meme stock craze)

- Seems that no shorts helping to calm volatility

Stock Market - Weird Facts

- The S&P 500 has gone 377 days without a 2.05% sell-off. That's the longest stretch for the benchmark since the great financial crisis

- The index hasn't experienced a gain of at least 2.15% in that time either

- The Cboe Volatility Index (VIX) is considered by many investors as the de facto fear gauge on the Street. Last month, it hit its lowest level going back to November 2020. On Friday, it traded around 13, near historically low levels.

- Complacency or Green-Light?

Home Prices

- Sales of previously owned homes are sitting at a 30-year low, and didn't move much in May as prices hit a new record and mortgage rates remain high.

- Many reasons - but no place to go, high rates and high prices

- IF more inventory comes on the market - possibly prices will come down (Last month inventories jumped 6.7%)

- Median price of a home sold in May was $419,300

More Homes

- Sales of homes priced below $250,000 were lower than a year ago, while sales priced between $250,000 and $500,000 were up just 1%. Sales priced between $750,000 and $1 million were 13% higher, and sales priced over $1 million were up nearly 23%.

- Cash is still king, accounting for 28% of sales.

- First-time buyers are hanging in at 31% of sales, up from 28% the year before.

MORE HOUSING

- April S&P Case-Shiller Home Price Index 7.2% vs. 6.9% Briefing.com consensus; prior revised to 7.5% from 7.4%

ERC Credit DENIED

- The IRS will deny billions of dollars' worth of claims for a pandemic-era tax break while working to process lower-risk filings, the agency said on Thursday afternoon.

- These are what you heard on commercials for a while...

- After investigating more than 1 million claims worth roughly $86 billion, the IRS said in the release that it identified 10% to 20% of the highest-risk filings, and "tens of thousands" will be rejected in the coming weeks, according to the agency. Another 60% to 70% of claims with an "unacceptable level of risk" will be further examined, the IRS said.

- During the ERC review period, the agency processed 28,000 claims received before September 2023 worth $2.2 billion and disallowed more than 14,000 claims worth $1 billion, according to the release.

TESLA

- Headcount reduction continues

- 14% of workforce has been slashed this year

-- The latest figure is not from precise payroll data, but from the number of people who are on Tesla's "everybody" email distribution list as of June 17

- Bloomberg reporting that Telsa looming for 20% total headcount cut in 2023 to benefit profitability after company reached inefficiency levels of 25% -30%

Musk - Need to know

- How many children did Elon father?

Banks

- Fed Stress Tests on Wednesday (all should pass)

- U.S. bank regulators said four major banks had shortcomings in their "living wills" - or plans that outline how they could be safely wound down if they went bankrupt or came under pressure.

- The four lenders - Citigroup, Bank of America, Goldman Sachs, opens new tab and JPMorgan Chase - all had problems related to the plan to unwind their derivatives portfolios, although some of the specific issues varied, the regulators said.

Boeing

- Looking to buy back Spirit Aerosystems after spinning off

- CEO Calhoun in hot-seat testifying before Senate panel about the door panel on 737 Max 9

- Also Boeing looking at potential for CRIMINAL charges (Relatives of crash victims urge prosecutors to seek $25 billion fine and criminal prosecution)

- U.S. prosecutors are recommending to senior Justice Department officials that criminal charges be brought against Boeing (BA.N), opens new tab after finding the planemaker violated a settlement related to two fatal crashes, two people familiar with the matter told Reuters.

------ Who will be criminally liable of the Justice Dept is victorious? Bord members, management?

NVDA - BOOM!

- NVDA passed Apple and then Microsoft in market -cap last week

- Up 170% this year

- CEO Jensen Huang became 11rh wealthiest person ($117 billion)

FED Update

- Many looking for September rate cut

- - NO WAY (unless the wheels fall off the economy quickly)

--- Neel Kashkari said last week that DECEMBER would be a reasonable prediction for a rate cut

- He has been somewhat level-headed out of all of the other speakers

China

- Retail sales beat expectations in May - up 3.7% (expectations were for 3%)

- Missed on industrial output and fixed asset investment

- Industrial output grew by 5.6% year-on-year, compared to the 6% increase expected, while fixed asset investment rose 4% compared to last May, just shy of the 4.2% forecast by the Reuters poll.

- Loan data released Friday pointed to continued lackluster demand. Outstanding yuan loans rose by 9.3% in May from a year ago, the slowest increase on record since 1978, according to Wind Information.

OIL

- Prices dipped to $72 support and then popped back up ($82)

- Next level of resistance above $83

- Houthi rebels are intensifying strikes in the Suez Canal which is prompting fears of high shipping rates and supply shortages, according to NY Times

Cocoa

- Prices of cocoa have more than tripled over the last year, creating a big headache for candy makers and other food companies that use the ingredient to make chocolate.

- Cocoa hit an all-time high of more than $11,000 per metric ton in April

- Many of the candy makers probably hedged out or long-term contracts

- Reuters reported that Ghana, the second-largest cocoa producer, is looking to delay a delivery of up to 350,000 tons of beans to next season, sending prices higher again.

SpaceX - Starlink

- SpaceX is rolling out a compact version of its Starlink antennas called "Mini," which the company is advertising as a mobile option for its satellite internet customers.

- The company is offering a "limited number" of the Starlink Mini antennas for $599 each in an early access release. That's $100 more than the base model "Standard" antenna sold with its Residential service, although the company aspires to reduce that price tag.

- Marubo Tribe in Africa is NOT addicted to porn (Story about getting Starlink and tribe was addicted to porn)

China EV Tariffs

- The European Commission said it will impose extra duties of up to 38.1% on imported Chinese electric cars from July, risking retaliation from Beijing which said on Wednesday it would take measures to safeguard its interests.

MORE EV

- Volkswagen is taking a $1 billion stake in electric vehicle startup Rivian , which has been seeking to cut costs and shore up cash amid slower-than-expected adoption of EVs.

- The companies also plan to establish a joint venture, which could increase the investment to up to $5 billion until 2026.

FedEX Earnings

- Reports Q4 (May) earnings of $5.41 per share, excluding non-recurring items, $0.07 better than the FactSet Consensus of $5.34; revenues rose 0.8% year/year to $22.11 bln vs the $22.04 bln FactSet Consensus.

- FedEx Express segment revenue was roughly flat yr/yr at $10.42 bln.

- FedEx Ground segment revenue rose 2.4% yr/yr to $8.49 bln.

- FedEx Freight segment revenue rose 1.6% yr/yr to $2.31 bln.

Co issues in-line guidance for FY25, sees EPS of $20.00-22.00, (Inline)

- Stock up 14% A/H

Wednesday Stocks to Watch

- Chipotle (CMG) stock spit goes into effect 50:1

- Google - ATH on Tuesday - can it continue?

Love the Show? Then how about a Donation?

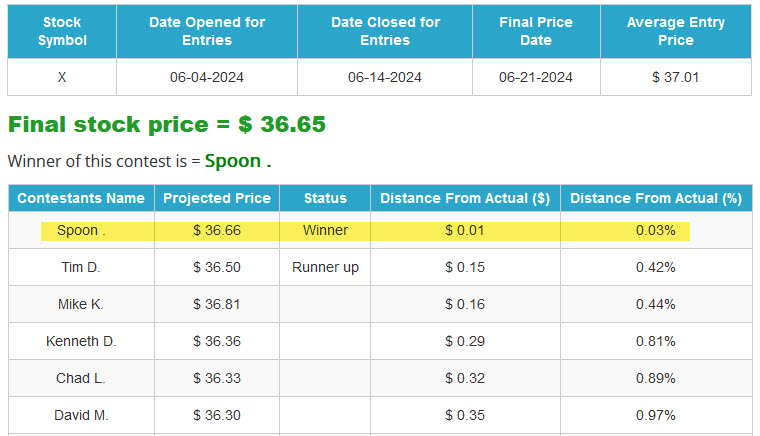

ANNOUNCING THE WINNER

Closest to The Pin for - US Steel (X)

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Podcast: Play in new window | Download (Duration: 1:00:35 — 55.8MB)

Subscribe: RSS