Here is our latest conversation …. new insights for anyone who invests in anything.

The European mess is getting messier. We take a look at some of the important risk indicators that are at the highest level since the Lehman bankruptcy. Also, Zynga’s options mess is contemplated along with some thoughts on the $5 billion lass at the U.S. Post Office.

Cisco (CSCO), Apple (AAPL), IBM (IBM), Groupon (GRPN) and other stocks are discussed.

____

____

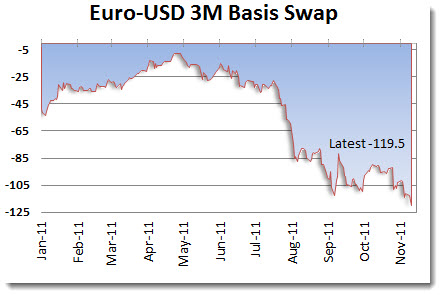

Euro 3M Basis Swaps – Hitting -119 is not good!

This is an important chart EU 3M Swaps – An FX swap agreement is a contract in which one party borrows one currency from, and simultaneously lends another to, the second party. Each party uses the repayment obligation to its counter-party as collateral and the amount of repayment is fixed at the FX forward rate as of the start of the contract. When the Euro/USD basis swap starts to move lower, it can be seen as a time when the risk of owning Euros over U.S. Dollars is increasing. Many believe that the -100 level is a key level that should be watched and -150 is a time when a crisis is occurring. Currently the level rests at -119, the lowest since the time of the U.S. banking crisis.

__

Looking for The Disciplined Investor Managed Growth Strategy?

Click below for the virtual tour….

___

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.

___

Weekly Stock Picks Tracking Spreadsheet

__________

Podcast: Play in new window | Download (Duration: 1:01:57 — 42.5MB)

Subscribe: RSS