Japan reeling after the BOJ implements negative rate policy - Yen up 5% since 1/29/16 and markets tanking (Nikkei dropped 5.5% last night) -- Japan 10-year falls below 0% for first time

FACT - Negative rates are not good for markets - Central Banks are now tinkering with tools they have no idea what outcome will be. (Yen rallying again tonight - now at 114.31)

Yen Chart

The biggest concern right now may be that China devalues the Yuan after the Chinese New year Holiday.

The global financial situation is getting worse as seen by the Contingent Default Swaps (CDS) - remember those?

CDS Spreads Chart

Interesting: Last year, the number of dividend reductions far surpassed 2008.

Dividend Reduction Trend

Goldman Sachs Abandons Five of Six 'Top Trade' Calls for 2016 - Inflation, dollar bullish call, Emerging market stocks, U.S. banks and a few others. So much for the big boy's being right...

There has been a lots of talk about a potential U.S. recession. There are lots of voices that are protesting that concept. There are some areas that are clearly in recession.

ISM Composite Chart

Oil at $30 a barrel is blowing a hole in the insurance that U.S. shale drillers bought to protect themselves against a crash. Companies including Marathon Oil Corp., Noble Energy Inc., Callon Petroleum Inc., Pioneer Natural Resources Co., Rex Energy Corp. and Bonanza Creek Energy Inc. used a strategy known as a three-way collar that doesn’t guarantee a minimum price if oil falls below a certain level, company records show. While three-ways can be cheaper than other hedges, they leave drillers exposed to sharp declines.

May be some market moving potential as Janet Yellen is giving testimony to congress over the next few days. Will the Fed dare to hike rates again anytime soon? (U.S. yields have slid since the rate hike)

What is this all about? A record 4,279 individuals renounced their U.S. citizenship or long-term residency in 2015, according to data released by the Treasury Department.

LinkedIn (LNKD) stock tumbles 50% after earnings release. Are advertisers feeling the pinch and finally giving up on some social media? (FB, TWTR follow lower after report) - We should have seen this coming - we knew Facebook had a new business service that was competition to LinkedIn.

SolarCity (SCTY) comes in way ahead of estimates, but the outlook is awful - stock down 25% -31% -35% -37%

Disney (DIS) beats on both earnings and revenues...Stock slumps after hours.

** Announcing the DHUnplugged Closest to the Pin Contest - The first CTP will start in March...

Listeners will be completing against John and Andrew *****

WHILE in attendance at the Super Bowl, Apple chief executive Tim Cook snapped a photo of the post-game festivities and shared it to his almost two million Twitter followers. BLURRY photo and followers gave him lots of crap about it.

Cook's Blurry Photo

India’s telecom regulator said Monday that service providers cannot charge discriminatory prices for Internet services, a blow to Facebook’s global effort to provide low-cost Internet to developing countries. Facebook’s “Free Basics” program provides a pared-down version of Facebook and weather and job listings to some 15 million mobile-phone users in 37 countries around the world. When it debuted in India in April, however, Free Basics immediately ran afoul of Internet activists who said it violated the principle of “net neutrality,” which holds that consumers should be able to access the entire Internet unfettered by price or speed. (LINK)

Daimler recalls 840,000 cars - potentially due to Takata Air bags ---- When will someone put an end to this company manufacturing bad airbags?

Deutsche Bank (DB)doing a massive bond repurchase program - stock up a bit on the announcement. What does this mean? (I think they are eating their own cancerous debt)

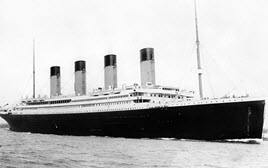

Is this a good idea? The Titanic II, an exact replica of the original is being built and will be ready to sail (or sink) in 2018. (LINK)

Sanders and Trump will New Hampshire - oh my (possible markets don't like any of the candidates?)

Results from the DHFed - WE HAVE A WINNER! - Max Humphreys guessed $4,650.00 (Within $3)