There are some things we need to know about who is actually buying stocks.

Yields on the rise – estimate that they could be moving up to what level?

Big tech earnings on tap – how will markets react?

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ?

Warm-Up

- Gold on a tear - not just gen pop buying

- Elephants buying up stocks - The BIG reveal

- Musk giving away $

- E-Coli Alert

Markets

- Yields cranking higher - steepening means....

- A bit of profit taking ahead of tech earnings (next week)

- More Tax abatements

- Markets look a little tired....

Treasury Rates

- The U.S. 10-year Treasury yield rose above 4.11% on Monday as investors awaited a flurry of speeches from Federal Reserve policymakers.

- This is a far cry from the lows before the latest rate cut about a month ago.

- Elections and debt loads are weighing as are the latest strong economic numbers

This too...

- The Biden administration rang up a budget deficit topping $1.8 trillion in fiscal 2024, up more than 8% from the previous year and the third highest on record, the Treasury Department said Friday.

- The deficit came despite record receipts of $4.9 trillion, which fell well short of outlays of $6.75 trillion.

- Government debt has swelled to $35.7 trillion, an increase of $2.3 trillion from the end of fiscal 2023.

- Interest expense for the year totaled $1.16 trillion, the first time that figure has topped the trillion-dollar level. (23% of receipts are used for debt service)

- The CBO expects deficits to continue to rise, hitting $2.8 trillion by 2034. On the debt side, the office expects it to rise from the current level near 100% of GDP to 122% in 2034.

The Big Reveal

- The central bank of the Czech Republic added to positions in some of the biggest tech names among U.S.-traded stocks, as well as increasing a bet on Warren Buffett.

- Czech National Bank Bought Up Palantir, Nvidia, Apple, and Berkshire Stock

- Here is my take.... (Central Banks reporting to other options as they are strapped and backs against the wall. They know they have enough firepower to pump stocks to try to dig themselves out of a death spiral of debt)

- Is it legal - yes. Is it good for markets, yes. Is it dangerous? Yes and no - if you can print money - who cares?

More...

Let's not forget about China rolling out $112 Billion scheme to bolster stocks

- China's central bank kicked off two funding schemes on Friday that will initially pump as much as 800 billion yuan ($112.38 billion) into the stock market through newly-created monetary policy tools.

- The central bank also launched a relending program, initially worth 300 billion yuan, that would allow financial institutions to borrow from the PBOC to fund share purchases by listed companies or their major shareholders.

- 1.75% is the rate to borrow and buy stocks

Revealed - Just a quick look....

- The Swiss National Bank has 20% of its assets in equities.

- The Bank of Japan buys Japanese ETFs as part of its domestic money market operations, but it doesn’t buy foreign stocks.

- The Bank of Finland does invest in equities

- Norges Bank, the central bank of Norway, buys stocks.

- Bank of Finland buys stocks

- Last quarter - Norway's gigantic sovereign wealth fund on Tuesday reported third-quarter profit of 835 billion Norwegian kroner ($76.3 billion)

- - - To date, the fund has put money in more than 8,760 companies in 71 countries around the world.

NO TAXES!

- Donald Trump said he’d consider exempting police officers, firefighters, active duty military and veterans from paying taxes

- Why not just have no taxes for everyone?

--- UPDATE: Former President Donald Trump's tax reform ideas could offer total or partial income tax exemptions to roughly 93.2 million Americans, or just under half of the U.S. electorate

---- Supposedly the income needed will come from tariffs (that is not a tax??)

ELON

- Elon giving away $100 to voters in PA - to sign a petition about

- "If you're a registered Pennsylvania voter, you & whoever referred you will now get $100 for signing our petition in support of free speech & right to bear arms. Earn money for supporting something you already believe in,"

- He is also gving away $1M per day

- Musk is promising to give $1 million each day to someone who signs his online petition, which reads: "The First and Second Amendments guarantee freedom of speech and the right to bear arms. By signing below, I am pledging my support for the First and Second Amendments."

- To be eligible for the $1 million, petition signers must be a registered voter and live in one of the seven swing states: Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin, according to the America PAC website.

- IS this legal - some say sweepstakes format is good.

CUBA

- Cuba's national electrical grid first crashed around midday on Friday after the island's largest power plant shut down, sowing chaos and leaving around 10 million people in the dark.

- The grid has collapsed three times since, underscoring the precarious state of the country's infrastructure.

- (Only 10 million people total in Cuba - so effectively entire country is out of power)

Some Relief?

- Spirit Airlines (SAVE) closed at a fresh low Friday.

- After the close, just before the deadline, they were able to extended the deadline for a debt refinancing with Vias and Mastercard

- Shares up 50% on the news

ECB Rhetoric and Rates

- Third rate cut this year, first back-to-back cut in 13 years

- Recent economic data supports case for reduction

- Quarter-point cut lowers benchmark ECB rate to 3.25%

- High interest rates have hurt investment, economic growth

- Lagarde says still on track for "soft landing"

META Layoffs

- Meta is laying off employees across units including Instagram, WhatsApp and Reality Labs, the Verge reported on Wednesday, citing people familiar with the matter.

- Separately, the Financial Times reported that Meta fired another two dozen staff in Los Angeles for allegedly using their daily $25 meal credits to instead buy household items including acne pads, wine glasses and laundry detergent.

- Meta has slashed around 21,000 jobs since November 2022 to keep costs low with CEO Mark Zuckerberg calling 2023 the "Year of Efficiency".

Chips - Taiwan Semi

- SMC, the world's largest contract chipmaker, bet on sustaining its strong growth, after reporting on Thursday a forecast-beating 54% jump in quarterly profit driven by soaring demand for chips used in artificial intelligence (AI).

- The company boosted outlook and is boldly confirming that AI investment is very real and very strong

Starbucks Earnings

- Starbucks projects Q4 revenue and earnings below consensus; global comps fell -7%; suspends FY25 guidance; increases quarterly dividend

- Funny - the Nike and Starbucks lovers were all over the news pumping when China announced stimulus - saying that NKE and SBUX would be direct beneficiaries

- Stock down 4% AH

JUST IN

- McDonald's shares down hard after hours

- Seems that the Quarter pounder is linked to e-coli outbreak

- - Interesting timing after Trump was serving just a couple of days ago

Love the Show? Then how about a Donation?

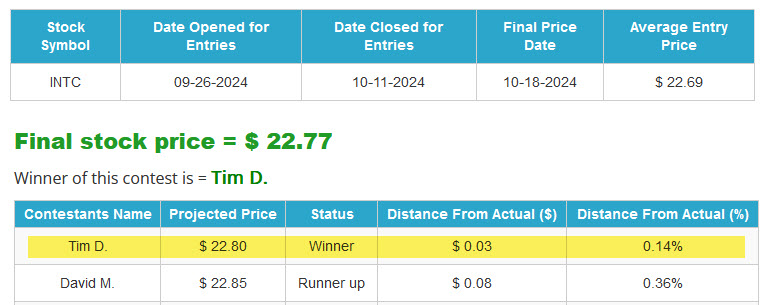

Announcing the WINNER for

The Closest to The Pin - INTEL (INTC)

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Podcast: Play in new window | Download (Duration: 1:03:49 — 58.7MB)

Subscribe: RSS