Yields important again – rising and worrisome.

Hedge Fund titans getting nervous – talking bout a Minsky Moment.

End of month – October is about to be in the books.

PLUS we are now on Spotify and Amazon Music/Podcasts!

DHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ? OHHH - the new shirt design is coming along...

SHHHHH- Leaking some of my own news... eNVESTOLOGY moving to $25,000 minimum in 2025. Currently at $10,000 so if you want to get in to that investment management program with us for the current minimum - now is the time.

Warm-Up

- Yields important again - all of a sudden

- Hedge Fund titans getting nervous - talking bout a Minsky Moment

- End of month - October is about to be in the books

Markets

- Earnings season - Tech is about to bombard us

- Gold near highs as China and India buying

- Election Direction - putting money where mouth is...

- Consumers are happier - UMICH

- NAZ 100 - ATH?

Yields - On the Move

Auto Divergence

- GM puts out some good numbers for recent quarter.

-- GM now expects full-year adjusted EBIT of between $14 billion and $15 billion, or $10 and $10.50 a share, up from between $13 billion and $15 billion, or $9.50 and $10.50.

- This marks the third time this year that GM has updated its guidance after beating Wall Street’s top- and bottom-line expectations, led by the automaker’s North American operations.

- Ford put out okay numbers, nothing exciting at this point - stock stuck in sideways action

- Big differential with stock performance over past year

New Threshold for Capital Gains

- Starting in 2025, single filers will qualify for the 0% long-term capital gains rate with taxable income of $48,350 or less and married couples filing jointly are eligible with $96,700 or less.

- Here is an idea - for low basis stock - possibly gift to non-dependents that have low income and they can sell at lower capital gains rate

--- Cannot do for dependents as their unearned income above $1,300 is the threshold.

Consumer Sentiment

- October Univ. of Michigan Consumer Sentiment - Final 70.5 vs. 68.9 Briefing.com consensus; October prelim was 68.9

- Markets reacted positively last Friday on this news.

--- Trivia: The University of Michigan (UMich) stopped releasing early versions of its Consumer Sentiment Index (MCSI) in 2013 as part of an agreement with the New York Attorney General's office. The university had previously received around $1 million a year from Thomson Reuters for this information.

Hedge fund big boys

- Getting nervous - Paul Tudor Jones

- The founder and chief investment officer of Tudor Investment said he was worried that government spending could cause a big sell-off in the bond market, spiking interest rates higher.

- Debt unsustainable and people just overlooking it

- "Will we have a Minsky moment where all of a sudden there’s a point of recognition that what they’re talking about is fiscally impossible, financially impossible?” Jones said."

- Commented how both candidates are spenders so that is not good - however, hard pressed to think that many of their spending promises will actually go through.

Minsky Moment Defined

- A Minsky moment is a sudden, catastrophic collapse of asset prices after a period of growth and stability. It's named after American economist Hyman Minsky (1911 to 1996), who believed that markets are inherently unstable and long periods of good markets eventually end in larger crises.

- A Minsky moment occurs when excessive debt accumulation becomes unsustainable. Borrowers can no longer meet their debt obligations using their income, leading to a sudden decline in asset prices and a financial crisis.

Housing Market

- Sales of previously owned homes unexpectedly fell last month, slowing to a pace not seen since 2010, when the U.S. was still recovering from a housing market crash.

- The National Association of Realtors (NAR) on Wednesday reported that existing home sales declined 1% in September from the prior month to a seasonally adjusted annual rate of 3.84 million, which is a 3.5% drop from one year ago.

Apple Airpods 2

- Hearing aids and hearing testing about to be launched

- Don't know how many people would like to ear all the time - most people will think that you are rude - non-discrete

- People that need hearing aids usually are all worried that it makes them look old and like them to be hidden

One Year Later

- BuyBuy Baby is shutting ALL of its stores after the new owners tried to revive the business

- Now they will be online only

- Perhaps if they paid attention the the pricing of their product they would have a better shot

- Junama Stardust Collection Baby Bassinet Pram $2,500

- on Amazon: Kinder King 2 in 1 Convertible Baby Stroller, Folding High Landscape Infant Carriage, Newborn Reversible Bassinet Pram, Diaper Bag, Anti-Shock Toddler Pushchair Stroller, Dark Grey $129

Fed contradictions - Breaking ranks

- On CNBC last week, Former Fed Governor Kevin Warsh discussed the Federal Reserve's (Fed) policy and its potential contradictions.

- Kevin, a former Fed Board Governor, expressed his puzzlement over the Fed's 50 basis point cut, arguing that it contradicts their previous statements about their policy.

- He criticized the Fed for not having a clear theory of inflation and for not being data-dependent.

- He also mentioned the Fed's shift in focus from core PCE to core services, excluding housing, and the importance of wages.

- Despite the dissent at the last meeting, Kevin maintained that the Fed members he knows do not play politics.

Earnings to Note

-- American Airlines third-quarter earnings and forecast for the last three months of the year topped analysts' estimates.

-----Earnings per share: 30 cents adjusted vs. 16 cents Revenue: $13.65 billion vs. $13.49 billion expected

-- Nvidia supplier SK Hynix posts record quarterly profit, beating expectations

----- Operating profit: 7.03 trillion won ($5.08 billion) vs. 6.8 trillion won Revenue: 17.57 trillion won ($12.7 billion) vs. 18.11 trillion won

- Tesla shares jump on profit beat, Musk’s prediction of at least 20% ‘vehicle growth’ next year

-----Earnings per share: 72 cents, adjusted vs. 58 cents expected Revenue: $25.18 billion vs. $25.37 billion expected

-- IBM Earnings

---- IBM missed analysts' estimates for third-quarter revenue on Wednesday, hurt by weakness in its consulting segment as businesses cut back on discretionary expenses, coupled with declines in the infrastructure business.

More Tesla

- Revenue increased 8% in the quarter from $23.35 billion a year earlier.

- Net income rose to about $2.17 billion, or 62 cents a share, from $1.85 billion, or 53 cents a share, a year ago.

- Profit margins were bolstered by $739 million in automotive regulatory credit revenue during the quarter

- Analysts now focusing on Gross Margins - as they were the shiny spot for the quarter

- Automotive revenues stalled for years - but energy generation picking up

- CEO Elon Musk said on the earnings call that his “best guess” is that “vehicle growth” will reach 20% to 30% next year, due to “lower cost vehicles” and the “advent of autonomy.”

-------Analysts surveyed by FactSet were expecting a total increase in deliveries next year of about 15% to 2.04 million.

- - Shares were squeezed up 20% at one point after the print

Chip-Gate

- Taiwan Semiconductor Manufacturing Company notified the U.S. that one of its chips had been found in a Huawei product after tech research firm TechInsights took apart the product, a person familiar with the matter said, revealing a possible violation of export restrictions on the Chinese company.

- The teardown was of Huawei's Ascend 910B, another source said. The 910B is viewed as the most advanced AI chip available from a Chinese company. The first source would not identify the item, but said the TSMC chip was one within a multi-chip system.

World Series

-Tickets for the 2024 World Series between the New York Yankees and Los Angeles Dodgers are expected to be the most expensive ever. The average price for a ticket on the secondary market is around $1,703, which is more than double the average price for the 2023 World Series. The cheapest tickets for Game 1 were $977 for seats in the right field bleachers

- Some seats are aaid to be going for $20,000

Fun! BBall

- Went to the opening game of the Heat - Pat Riley dedication of the Court

- LeBron James and his son Bronny became the first father-son duo to play together in a regular season NBA game on Tuesday as the Los Angeles Lakers beat the Minnesota Timberwolves in their season opener.

In Closing...

- Apple announces that it is testing blood-sugar app

- Looking to continue its adventure into health related apps

- No-prick technology is being tested

Love the Show? Then how about a Donation?

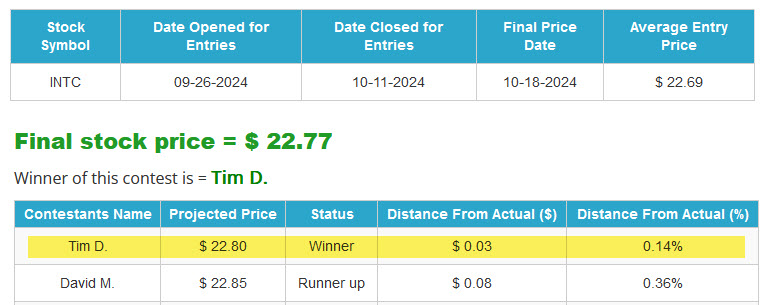

The WINNER for

The Closest to The Pin - INTEL (INTC)

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Podcast: Play in new window | Download (Duration: 1:01:57 — 57.0MB)

Subscribe: RSS