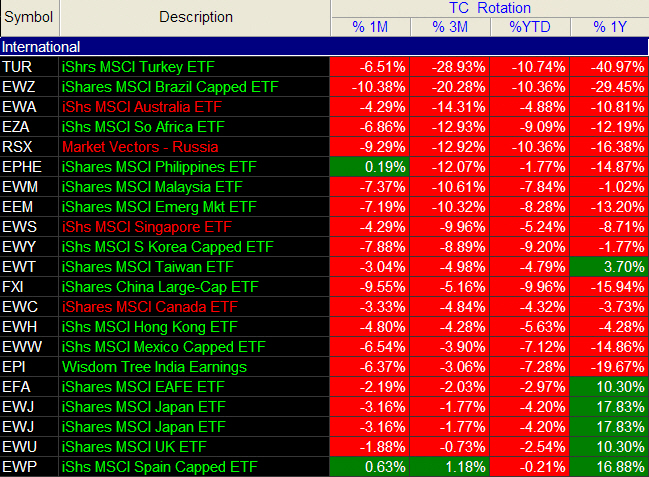

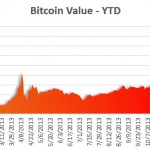

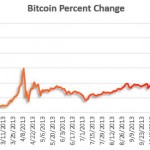

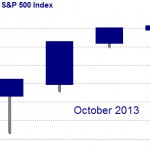

Much of the same after the big drop due to Emerging markets. However, we get into the real details of whether or not January’s market direction is a good and reliable barometer for the year.

Horowitz has a series of trading indicators now available for Tradestation – HERE

Disclosure: Horowitz & Company clients may hold positions of securities mentioned as of the date published.

Podcast: Play in new window | Download (Duration: 1:01:14 — 42.0MB)

Subscribe: RSS